On an average it costs about $367 per month to buy Home Insurance in Texas. It may vary based on your home’s condition and its location. Discover various Home insurance companies and the ones with cheapest & best coverage plans. Also, analyse how much is home insurance in Texas per month?

What is Home Insurance Cost Per Year in Texas?

Do you know? Texas ranks at 5th position, being most expensive State – Home insurance pricing. Home insurance in Texas costs about $367 per month, about 130% higher than the average annual national value. The average national cost is about $1,915 per year.

Besides, the best affordable home insurance companies are Chubb and State Farm.

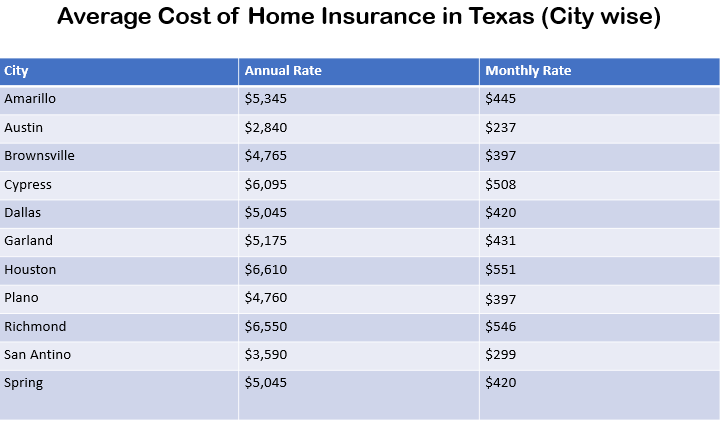

Find out, how much home insurance in Texas per month city wise. To say, it costs about $445 monthly in Amarillo, $237 in Austin, $551 in Houston to buy home insurance. Thus, the cost of home insurance per month varies with city too.

If any person possess Poor credit pay, the annual cost for home insurance is $7,705. This estimates about 75% of the value it holds for home insurance annually. It also includes numerous other benefits like – Poor credit payment benefits and property benefits.

What’s covered by home insurance? Mainly, home insurance offers six types of coverage. It includes Dwelling coverage, Personal property, Liability coverage, Medical payments, Living expenses and Structural damage coverage.

Now, you would ask which companies offer Home insurance in Texas. There are several ones – like State Farm, Travelers, USAA, Nationwide, Amica, Chubb and Cincinnati Insurance. Their monthly costs differ based on the facilities they offer. Amica costs about $6,780 annually, while USAA cost about half the cost of previous one – $3,450 yearly.

Who has the cheapest homeowners insurance in Texas?

Some Home insurance providers costs less than the national annual average of $4,400. It include Texas Farm Bureau, State Farm, Farmers and USAA. Among these Texas Farm Bureau is cheapest one which costs about $2,835 per year. On the other hand, USAA offers insurance to military & veterans, pricing about $3450 per year.

The above mentioned Home insurance providers offer better coverage at cheaper & affordable rates.

Some cities like El Paso and Austin provide Home insurance at the cost of $200 and $237 respectively which is the minimum amount.

What does Home Insurance covers?

The home insurance monthly pricing in Texas varies with the location and home condition. But it get you assured coverage of personal property, liability coverage and structural coverage.

Dwelling coverage refers to compensation paid for damage to property, if anything is damaged or stolen then it will be covered under Personal property coverage. And if you’ve underwent any financial crisis the Home insurance also provides compensation to it too.

Besides, it also bears the payment of Medical expenses too through Medical Payment coverage. Some expenses are provided under Additional living Expenses, like rental amount, food costs and many other expenditures too.

Why is Texas homeowners insurance so high?

On discovering different Home insurance providers, you may felt high pricing in Texas than other State. It is because Texas is more prone to Natural Calamities. Wildfires, Tornadoes, Hailstorms and Hurricanes can literally damage your property. So it is obvious, higher the risk more are the coverage charges.

Moreover, if you need to file any complaint against your Insurer, contact Texas Department of Insurance directly. This looks for the type of issue you met and resolves accordingly, provided you have TDI’s Consumer Bill of Rights copy.